OUR RESEARCH

On this page, you’ll find synopses of our latest monthly reports. Each provides in-depth analysis of recent global macro events and their impacts, with clearly highlighted associated trade ideas. Exclusive JDI Research charts always complement our analysis, supporting you in trading with conviction.

Apocalypse never?

...How long can wealth gains keep disaster at bay?

Juliette Declercq

13th November 2025

This month’s Roadmap dives into the three big wildcards as we race towards 2026: a labour market quietly sliding toward a severance shock, a consumption boom running on AI-fuelled fantasy gains, and a hyperscaler AI race that’s burning cash faster than it anyone can build a monopoly – with real consequences for jobs, inflation and yields. Add a Europe that’s quietly out-executing everyone, and the consensus narrative starts to wobble. If you want the real inflection points – and the trades they trigger – they’re in the this report.

Welcome to the Champagne Republic...

...Where bubbles keep the party going well into the night.

Juliette Declercq

6th October 2025

This report charts the birth of a new economy – a Champagne Republic where the asset-rich carry consumption and the risk-parity party lasts well into the night. A wealth effect masquerading as strength keeps recession at bay for now. But beneath the glitter, labour demand is decaying, real incomes are stalling, and inequality is widening as AI turbocharges the transfer of wealth from workers to capital owners. The trade opportunities in this new age are plentiful, but so is the risk…

AI is more than an equity hype train...

...It's a labour bloodbath

Juliette Declercq

4th September 2025

This report is essential reading – not just for you, but for your kids. While markets celebrate low unemployment and incoming Fed cuts, the reality is far darker: AI is slaughtering opportunities for young workers and dismantling the low-skill/low-experience labour force. Payrolls are already on a precipice. Ahead, expect stagnant wages, falling income expectations and rising frustration as a generation sees its prospects vanish.

A brave new world...

...And it doesn't belong to Trump

Juliette Declercq

25th July 2025

Markets have been unusually quiet as the 1 August tariff deadline looms – no major macro shifts, no data fireworks. Meanwhile, our trades are playing out and our strategy for H2 is on track, giving us a rare opportunity for a deep dive into the long-term trends shaping markets. In this report, we tackle globalization. Everyone is quick to blame Trump for killing it, but we reveal how the world is quietly stitching itself back together – and how Europe might just come out ahead.

From TACO to PACO...

... Powell can't hide behind 'uncertainty' forever.

Juliette Declercq

25th June 2025

In our previous report, we argued that market forces would act as a check on Trump 2.0. First came the warning through tariffs; next, we expect a reckoning via fiscal policy. Today, we extend that thesis: economic forces will also serve as a check on Powell. Make no mistake, our 2025 outlook is still in motion, and the story is far from over.

Out of the tariff pan...

...And into the fiscal fire

Juliette Declercq

22th May 2025

Our title says it all: In 2025, whether he likes it or not, market forces will check Trump 2.0. After the tariff warning, we are headed straight to another disciplnary warning, this time focused on fiscal policy. Ultimately, macroeconomic fundamentals will prevail, but Trump remains determined to push back. This ongoing clash fuels volatility and creates trading opportunities.

So, who will blink first: Powell or Trump?

... Depends how fast term premia smack Trump into playing it straight.

Juliette Declercq

12th April 2025

Fresh data is in—and it’s screaming recession.

Yesterday’s Conference Board survey showed consumer expectations crashing to a 13-year

low, while JOLTs revealed employers pulling back as tariff worries mount. These critical

indicators give a clear message, exactly as we flagged in our April Report: “hard data is

about to have a hard time.

Ask not what America can do for you ...

... Ask what you can do for America

Juliette Declercq

5th March 2025

Our analysis and strategy are on track. The question now is wether we can avoid a global recession. This is still possible if Trump refrains from hitting the EU with tariffs. You will find everything you need in this report to continue navigating the tumultuous 2025 waters with success. Let's see what March brings in terms of tweets but I will continue to focus on macro textbooks. Inshallah!

Textbooks Not Tweets ...

... Your guide to trading Trump in 2025

Juliette Declercq

23rd January 2025

In this new report, we argue that investors success in 2025 stems from a deep understanding of the macroeconomic forces at work. Yes, Treasury secretary Scott Bessent is an astute sailor, but the sea of markets is a cruel mistress.

JDI's 2025 Outlook:

Juliette Declercq

22nd December 2024

This December, our full report takes the form of a webcast, covering 40 key charts likely to drive the global macroeconomic landscape in 2025 and define clear trading opportunities.

Beware, the level of uncertainty is high, but I trust that my framework will support you make the right investment decisions.

Who is the real election winner?

... Musk or the US economy?

Juliette Declercq

18th November 2024

A comprehensive analysis of the post-election likely macro backdrop and ramifications to markets.

Beware, the level of uncertainty is high, but I trust that the report will help you make the right investment decisions as we get increasing clarity on the political path ahead.

I will certainly continue updating you along the way.

1. Everyone wants economic growth...

... But how much will they pay for it?

2. Expect an immigration crackdown...

... With whiplash for wages and final demand

3. Building a new kind of wall around the US...

... Are tariffs a key bargaining chip or a foolish bluff?

4. Tax cuts and deregulations...

... Political promises hit the hard truths of reality

5. Curbing the Fed's independence...

... and risk returning to the Dark Age of financial repression?

6. Markets have caught Musk mania...

... But what is the prince of productivity really up to?

Election circus vs economic cycle …

... There is only one winner

Juliette Declercq

24th October 2024

Extract of themes and topics covered and analysed in our October report:

1. Your usual dead-cat bounce, or a statistical miracle ...

... Has the US labour market really turned a corner?

2. Consumer to the rescue ...

... But how long can income and spending prop up the economy?

Too little too late, or better late than never …

... The Fed is dancing with disaster

Juliette Declercq

12th September 2024

Extract of themes and topics covered and analysed in our September report:

1. Was US exceptionalism just a mirage?

... Recession alarm bells are clanging

2. 25bp or 50p on September 18th?

... FOMC members may need to smell fear to stop procrastinating

3. So what about outside the US?

... Recession bells are clanging there, too

From party poppers to cycle stoppers ...

... Take shelter as the US stutters

Juliette Declercq

10 July 2024

Extract of themes and topics covered and analysed in our July report:

1. NFProblems: From a healthy rebalancing ...

... To more sinister late-cycle behaviour

2. "Don't short a dull market" ...

... But shield in TIPS until the storm passes

Between a rock and a hard place ...

Juliette Declercq

4 April 2024

… Have the Fed creeps chosen the least painful mandate?

1. The Fed's dovish stance ...

... Risks its inflation credibility to extend the business cycle

2. Now on high alert for a cyclical inflection ...

... Which will see the Fed compromise its values

Dormant or dodo?

Juliette Declercq

26 January 2024

… Inflation is not extinct just yet.

1. Inflation: Dead or dormant?

... A deep dive into the Fed's reaction function

2. The Euro area recovers but remains a laggard

... Yet, the Fed will likely beat the ECB to the punch.

3. The Bank of England's credibility is the most at risk

... Rates are not restrictive, and is it even targeting 2%?

Rates take five, markets revive ...

Juliette Declercq

20 November 2023

… We can hit snooze on that hard landing.

1. Inflation vanishing act to reawaken the European consumer?

... With a 6-month lag to the US real income sweet spot

2. US: Beyond its economic sweet spot

... A sour aftertaste is the way off: Expect a slow landing

The agelong ascent to the summit...

Juliette Declercq

14 September 2023

… Are restrictive rates finally in reach?

1. Is the Fed's terminal rate finally in sight?

... What will break the economy?

2. If the housing market does not trigger a recession...

... Surely the labour market will?

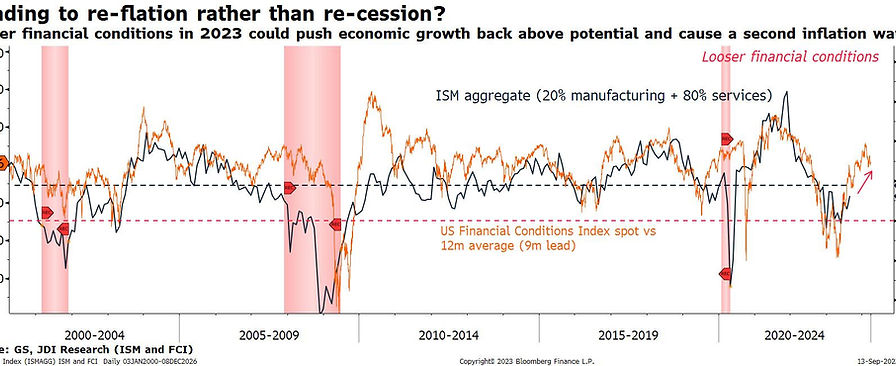

3. A second inflation wave in the offing?

... Soft landing is now off the cards

What landing?

Juliette Declercq

10 August 2023

Perhaps the recession is already in the rear-view mirror…

1. "Immaculate" disinflation: An obituary

... Fading base effects, stalling goods disinflation and stubborn services inflation

2. Soft landing? What landing?

... Perhaps the recession is already in the rear-view mirror

3. Primed and ready for a reset...

...Will it be the Fitch downgrade or the BoJ lighting the term-premia powder keg?

4. The UK epitomizes the world's inflation problem

... Markets are way too complacent with term premia there

All about wages...

Juliette Declercq

7 July 2023

… with wildly divergent trends from UK to Japan

1. Immaculate headline disinflation

..Just as I expected

2. Disinflation. Act1, Scene2: Pure pleasure

... Stabilising prices and persistent wage gains; Central Banks have achieved the paradoxical feat of stimulating demand with higher rates

3. Disinflation. Act 2, Scene 1: Gloom

... Just as we celebrate the Fed hitting the inflation target, a recession will start

“Toto, I’ve a feeling we’re not in Kansas anymore...”

Juliette Declercq

30 April 2018

The USD should stay on its knees short-term

Juliette Declercq

7 February 2017

Running out of reasons to avoid Emerging Markets......

No paradigm shift toward reflation …

But deflationary tail risks have abated

Juliette Declercq

25 July 2016

In the last report on July 5th, I discussed at length the possibility of Central Banks passing the baton to the Finance Ministries as a main threat to my positive view on long end fixed income at a time when it had largely become consensus......

Seeing the wood for the trees ...

Juliette Declercq

22 June 2016

Let us all be clear, I have no crystal ball and although I do believe that remain will be the outcome of the referendum; it is also what 90% portfolio managers I speak to believe, which really puts us in a bit of a pickle as to the best way to strategize and monetise a view over the event....

It pays to take risk ... re-entering short USD

Juliette Declercq

6 June 2016

My view has been more neutral on the USD recently after a successful foray into longs (closed after the hawkish fed minutes) and I have been thinking long and hard about it today. I want to re-enter short USD and decided to pick CAD ......

Not much in the way of further USD gains ...

Juliette Declercq

16 May 2016

It is tempting to take profit on long USD initiated on the last piece following a great run but the Fed is not likely to show its dovish hand again in the short-term, which means that the trade still has legs for reasons we expose in today's report......

Calling the end of the USD countertrend

Juliette Declercq

5 May 2016

I took profit in all USD short versus risk-on FX position last Friday on a view that all my long term price targets had been hit in EM FX and that EUR and JPY strength would cause a VAR shock. I think it is fair to say that this VAR shock has happened. In the process, USD hit a cyclical low before storming back on Tuesday and marking impressive reversal signals (see chart above). A clear inflection point (it is no surprise that it was on the same day die-hard USD bulls started to soften their stance and on the day the controversial Shanghai accord was finally confirmed as part of the new treasury FX report) that most likely marks the end of the 2016 USD bear trend theme that I have been riding successfully since January....